What Is The Economic Clock?

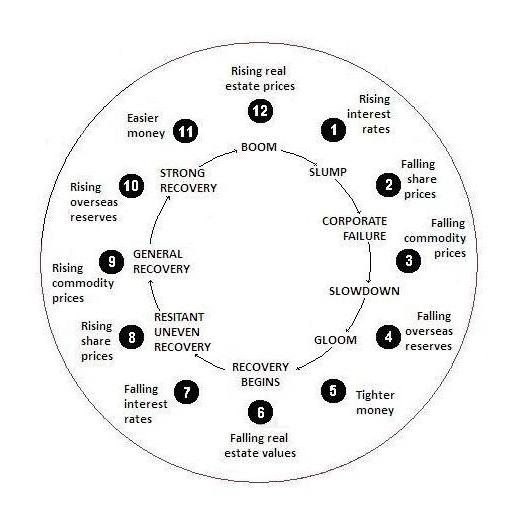

The economy is said to go in a cycle. The economic clock is to demonstrates this movement in a cycle to indicate when is a good time to buy certain types of investment or when not to buy.

The economic clock is not to be taken as an acturate time to buy to quickly become wealthy but instead it is just an indicator to guide us in our investment diccision.

For example, if it was two o’clock then neither share or property is likely to be the best investment option.

The Six O’Clock Recession

The defination of recession, is to define a contraction of an economic cycle. The economy is measure in terms of Gross Domestic Product (GDP). In general when GDP is contracting over a period of time for more than two consecutive quarters. The economy is in a recession.

During a recession, the demand for goods would be lower. Employers would reduce the number of staffs in their organisation in order to lower overheads. This will then lead to high unemployment rate and less in consumers spending.

The economic clock is at 6 o’clock, when the economy is in a recession.

The Recovery Begin.

A recovery from recession begins from 6 o’clock till midnight.

Governments start to impliment spendings from budgets and increase of revenue collection to influence the economy.This is known as the Fiscal Policy. This fiscal policy which in turn will increase the demand on private sector businesses that would start to employ more staff to cope with increased production needs.

Central banks will also apply Monetary Policy by controlling lower and attractive interest rates, so as private businesses are prompt to borrow and invest in capital projects.

As the hour hands passes between 6 o’clock until midnight. Stockmarkets and commodities prices are rising. Market analysts suggest, this is the best time to start investing in order to obtain higher earnings and bigger profits.

But as the hour hand reaches 11 o’clock. The buying becomes more aggressive. Those who have missed out on the early stockmarket gain start to buy now believing that prices will rise even higher. However, when the speculative bubble pops they are stuck. This phenomenon is known as the Greater Fool Theory.

The opposite of the greater fool theory is value investing. These are the early investors that started buying at discounted prices or when the stockmarket was trading at it’s lower price. This value investing concept is possible only due to the greater fool theory.

The Midnight Correction

When the clock strikes midnight. The Bull Market comes to an end, stockmarket and commodities prices are falling.

The greater fool investors are stuck with their investments hoping a greater fool will buy at a higher price. While the value investors have exited the market and are looking for the next opportunity.

Property ‘Till Three O’Clock

The smart investors that ‘got out’ at the top move into property with reliable ‘bricks and mortar’.

Extra demand in property pushes demand above supply and results in higher prices.

This itself isn’t a problem, except that the government sees the economy is overheating and looks to introduce measures to enable a ‘soft landing’ through increasing interest rates to flatten demand by consumers.

With higher interest rates comes less profit in real estate since most investors have leveraged their property purchases. Rises in interest rates continue until it is no longer viable for purchasers to continue investing in property and soon there are more sellers than buyers. Property prices, like share prices, correct.

There is trouble on the way.

Decline Back To Six O’Clock

Decline begins as business confidence begins to fall. Investors find little value in either stocks or property and with impending trouble on the horizon fixed interest securities become very popular again.

Lower business confidence means that new capital ventures are postponed.

Less spending and higher interest rates result in lower demand, which results in less production. With fewer sales there is a squeeze on earnings, resulting in profit downgrades.

The economy slows to the point where productivity stalls and then declines. When this happens for two periods in a row, the economy is said to be in a recession.

Take a guess. What Time Does The Economic Clock Show?

| 6 o’clock | midnight |

| 7 o’clock | 1 o’clock |

| 8 o’clock | 2 o’clock |

| 9 o’clock | 3 o’clock |

| 10 o’clock | 4 o’clock |

| 11 o’clock | 5 o’clock |