JOHN MELLOR has a wide-ranging discussion with Porsche Cars Australia chief, Sam Curtis over a cup of tea in the newly refurbished Porsche Centre Melbourne.

- Why dealers bought into Strategy 2018 plan

- SUVs are powering Porsche sportscar technology

- Macan demographic was a surprise

- Porsche Cars Australia lives by the 10 per cent rule

- Porsche Cars Australia to pause to catch its breath.

- A fine balance between volume and excess

- Customer programs meet increased demand

- Customer recognition at Porsche is vital

Sam Curtis

THE new super-sized showroom, part of Porsche Cars Australia’s head office in Victoria Parade, Collingwood, is bustling.

The showroom of the Porsche Centre Melbourne now has 23 cars on display and many of them are lined up as if on a starting grid waiting for Glen Dix to leap out with a starters’ flag and wave them on their way.

It is an impressive sight. So are the pricetags, At six figures, many prices have a two or a three in front of them. A four even.

With prices in such a rarified atmosphere you would expect the place to be somewhat subdued.

But no. There are buyers in evidence at various sales desks and others are inspecting cars. The coffee shop is about half full including some children with their mother.

Out on the floor, a father and (probably) his adult son are talking around a Carrera. A nuggety weathered gentleman who might be a concreter or market gardener is looking at a Cayenne and a salesman is talking to a couple in Mandarin about a Macan.

I am waiting for an appointment with the boss; Sam Curtis who is CEO and managing director of Porsche Cars Australia. A concierge has helped me park my car and taken me to reception where a very efficient young lady is fielding enquiries on the phone.

As I wait, wandering the showroom, half a dozen friendly people have asked how they can be of service. Maybe one day.

This is the newly-minted Porsche where the company has made the leap from being a prestige sportscar maker selling 1000 cars a year in this country to a seller of prestige sportscars on steroids to a completely new group of buyers.

Last year the company sold 4000 units in Australia, four times its traditional activity.

In the motoring world, the kind of sales improvement achieved by Porsche in the past four years would generally only be the result of ambitious factory production schedules and ruthless stocking programs at the expense of margins and feckless treatment of customers.

But Sam Curtis says with pride that the company has managed the huge jump in volume without ruffling the feathers of the traditional sportscar buyers and has welcomed many completely new buyers to the brand and smoothly absorbed them into Porsche’s family of customer programs.

The secret seems to be that rather than trying to dominate the global prestige car market with reckless volume drives, as some premium brands are doing, Porsche Cars Australia (and Porsche AG) believes the right balance in terms of volume, profit and customer relationships is to hold sales at around 10 per cent of the segments in which they compete and reap their growth.

Why dealers bought into Strategy 2018 plan

Mr Curtis told GoAutoNews Premium: “Back in 2012 Porsche AG released what we refer to today as Strategy 2018 which outlined a six-year window of where Porsche globally wanted to be. There were a number of KPIs both qualitative and quantitative and the quantitative was the sales volume.

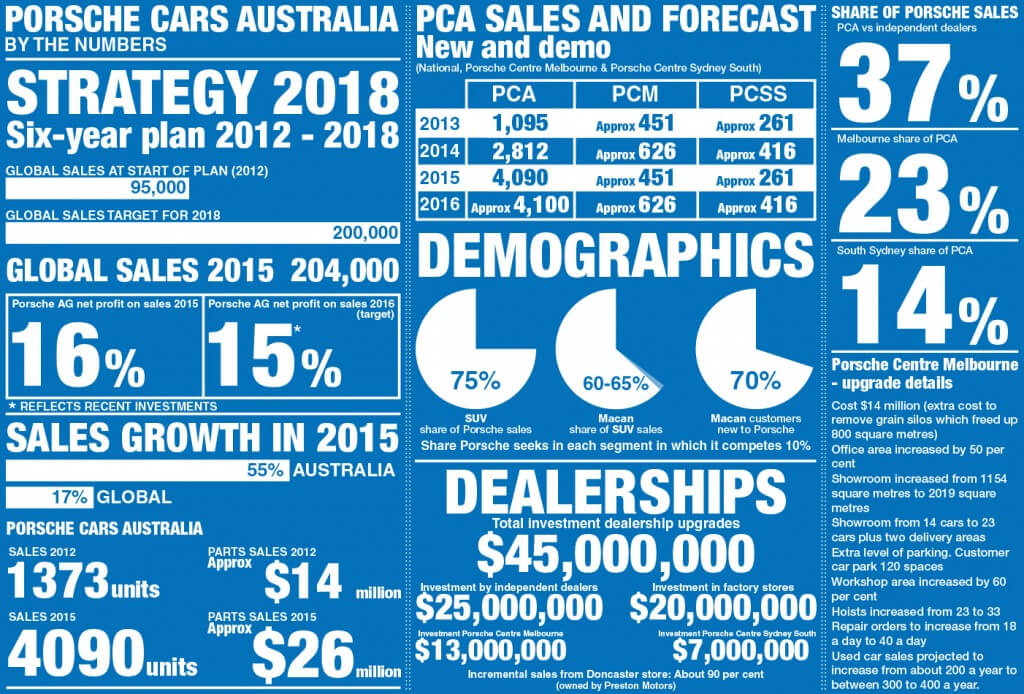

“Back in 2012 Porsche globally was selling less than 100,000 units. The plan was to double sales in that six-year window . So we would have gone from around 95,000 to 200,000 by 2018. But last year Porsche AG delivered 220,000. So, we are three years ahead of the game plan.

“In that road map, of course, we had to make sure that our dealers were ready for the increase in sales volume and tell them about what lies on the horizon

“We sat with our dealers – we had 12 at the time – and ensured that each of them was ready for increased sales volume – both from a facilities perspective with showroom and workshop but from a staffing resource point of view as well; be that sales people, technicians or administrative staff. So there was pretty much a road map for each of the dealers and some were more advanced than others.” he said.

The plan called for a $20 million upgrade of the factory stores in Collingwood and South Sydney funded internally by PCA and another $25 million to be spent by the other 12 Porsche dealers around Australia.

(Click here ‘Porsche unveils new Australian flagships’ )

And, in spite of appointing Preston Motors to open dealerships in Melbourne’s well-heeled Brighton and more recently Doncaster, such is the growth in Porsche volume that the new Porsche Centre Melbourne is projected to sell as many Porsches this year as the company sold nationally six years ago.

Mr Curtis said the Porsche Centre Melbourne will be operating at maximum capacity within a year.

Porsche Centre Melbourne is projected to sell as many Porsches this year as the company sold nationally six years ago

The Melbourne dealership represents about 23 per cent of total Porsche sales and

Sydney South, the second factory store, is close to 14 per cent. So between the two dealerships there is in excess of 35 per cent of the total Australian volume.

The decision to open a dealer point in Doncaster was also off the back of concern about how many cars could physically be delivered out of the Melbourne dealership.

“Obviously when we were projecting our sales volumes we thought that we would not achieve it by only having two dealerships in Melbourne. As it has turned out, Doncaster has had a very good year (in 2015) and about 90 per cent of the business has been incremental. There has been some shift from our store and possibly from Brighton but in the main it has actually be incremental business.

“Doncaster is in an auto hub out there and they are seeing a lot of that business coming across the road from BMW and Audi. The Macan is the one that’s doing it. There is probably more defection out of those two camps than there is out of our camp into theirs.” he said

Doncaster is in an auto hub and they are seeing a lot of that business coming across the road from BMW and Audi

“Dealers in other states have gone through similar redevelopment projects. They have also seen in excess of 100 per cent sales growth in their businesses. The extent of service department growth is probably not dissimilar to here.

“It is really a compounding effect. The investment has been quite significant for the dealers but clearly it has been justified. So we have some very happy dealers because we are at the sales volume that makes sense for them in terms of the commitment and the spend on the investment,” Mr Curtis said.

SUVs are powering Porsche sportscar technology

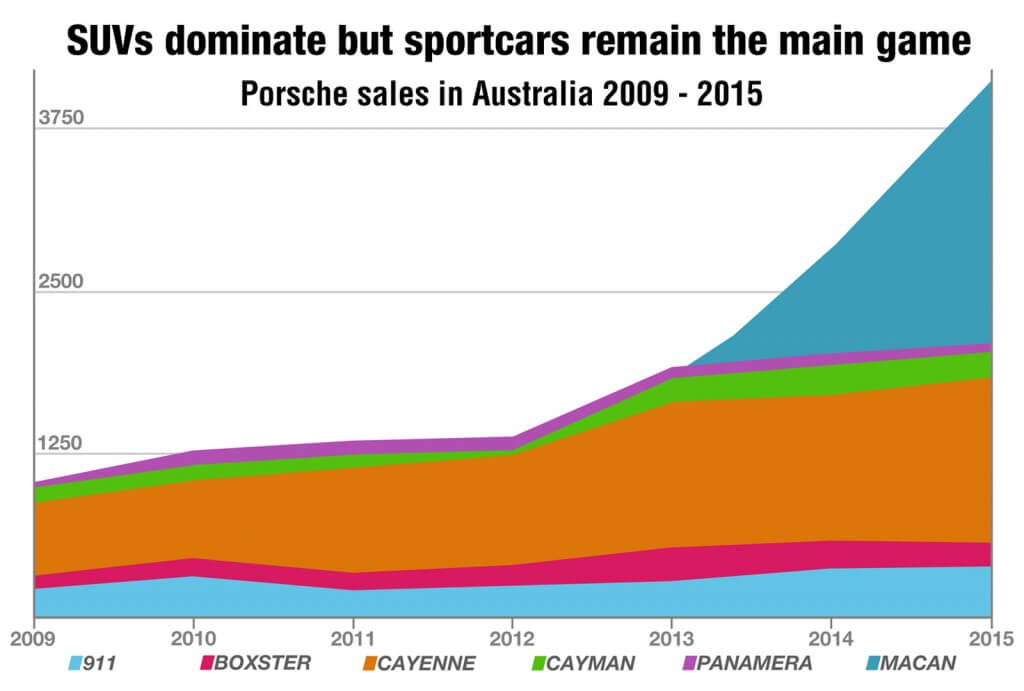

All this growth was driven by the concept of the two-Porsche family with the Cayenne and, subsequently, the Macan, which pitched Porsche into a segment it simply could no longer ignore.

Mr Curtis said that the two-Porsche family was brought about by former Porsche boss, Wendelin Wiedeking, with the Cayenne.

“The man who buys the 911 for himself has to placate his wife. But he was forced to provide an SUV for the family from another brand. So Wiedeking wanted the Cayenne so the 911 buyer could put his wife into an SUV of the same brand. That was the origin of the two Porsche family.

“There are many households now that have the sportscar and the SUV in the driveway but back before Cayenne days there was just the sport car. It had to happen and it was the commercial reality of it that it needed to happen. Of course we have never looked back.

“So we had that road map and Porsche has obviously exceeded the goals and objectives that we had and that is off the back of the the unprecedented sales volume for the Macan – which brought the brand into a new part of the market more in reach of everyone who ever wanted to own a Porsche.”

Mr Curtis said: ”It is the biggest growing segment. Everyone wants to be in it. Now Jaguar. It is THE segment. Probably we were a bit late coming into it but the fact is we needed to do it and we are not shy of saying that around 75 per cent of our sales are made up of SUVs and, of that SUVs total, Macan make up about 60-65 per cent. So it is obviously our volume seller.”

So the company has cleverly generated strong revenues from outside the sportscar world to fund R&D investments in sportscars well beyond what one could expect from its sportscar volumes.

In addition, Porsche – in spite of being a low-volume manufacturer – has always been in the uniquely beneficial position of operating its own independent Porsche Engineering consultancy. Porsche Engineering designs, develops and tests some of the most advanced new technology for cars attracting lucrative fees from automotive clients around the world.

While obviously careful to erect Chinese walls of secrecy around clients’ development programs, the company is nevertheless a repository of design and technological knowledge that goes far beyond what it could hope to generate on its own behalf from its relatively modest sales; so its products are the beneficiaries.

But Mr Curtis said Porsche now finds itself in an even more enviable position where “the income streams from the SUVs allows us to build a better sportscar going forward.

“The 911 remains the backbone of the organisation but we use the income stream from the sales of SUVs so that we can make the 911s and our sportscars the best sportscars in the world and people buy our SUVs because we make the best sportscars in the world.

“It is self-fulfilling in a way and we are okay with that,” Mr Curtis said.

We use the income stream from the sales of SUVs to make the best sportscars in the world and people buy our SUVs because we make the best sportscars in the world

“So it made sense. Porsche had to have SUVs because the Macan helps to produce and deliver the sportscars that Macan owners may well want to own in time.”

Macan demographic was a surprise

Mr Curtis said that the success of the Macan was not age or gender specific.

“It is appealing to the younger female, the older male and everyone in between and that is why it has been a phenomenal success globally. Seventy per cent of those buyers are not previously known to Porsche.

Seventy per cent of those buyers are not previously known to Porsche.

“That has to be good business because, once you get them in, the whole loyalty factor hopefully then kicks in.”

He said the demographic for the 911 remains the same “but we are seeing a whole new demographic for the Macan.

“We launched in May-June 2014 and at that stage we had planned for a much younger buyer with some conquest business from the other brands. But in the first year we saw the typical Porsche demographic – 45 years plus. However now they are being seen on the road we are now seeing that younger buyer.

“So the younger buyer – not known to Porsche – waited for it to arrive before driving it and experiencing it before purchasing it.

“There have been two waves. The initial wave: Typical Porsche buyer; must have one. Want to be the first.

“The second wave are the ones we have conquested. These are the 70 per cent of all Macan sales that are new customers to Porsche.”

Porsche Cars Australia lives by the 10 per cent rule

The growth made ordering of the Macan a challenge.

“In 2014 we had to make a decision about Macan volume. That was always going to be a tricky one because it was new to us. But we looked at the segment and made a determination to be 10 per cent of that segment.

“So that was a hand-on-heart moment that we were going to bring X units into the country and the story goes on that within six months we had an order bank of eight to nine months. So we probably (could have) brought more in at the time but that’s okay because we would prefer it to be tighter. Today, a year and a half later, our monthly intake on Macan is the same as when we first released it.

The figure of 10 per cent of its segments looms large in the Victoria Parade head office and in its despatches to Germany.

The figure of 10 per cent of its segments looms large in the Victoria Parade head office and in its despatches to Germany.

Discussing the Panamera, for example, Mr Curtis said: “That segment in a good year is maybe 1100 units and in a bad year it is 800 and we like to think we are good for 10 per cent of that segment. This would obviously mean numbers greater that current sales for next year or when we launch. We will probably do a similar number this year (as in 2015).

But the company is not solely SUV driven. Last year Porsche had is best sportscar year since the GFC and the 911 had one of its best ever years last year. In Australia it had its best 911 year since 2007.

Some of this was driven by a decision in 2013 to reposition the pricing of the 911 across the model range.

“We dropped the prices by 10 per cent. There was some concern at the time but we justified to Germany that if they wanted uplift (in sales under the strategy plan) then we needed to correct the pricing because we were a little bit out of kilter,” Mr Curtis said.

Porsche Cars Australia to pause to catch its breath.

Porsche Cars Australia in 2016 is coming off the back of spectacular growth of 55 per cent in 2015. This makes Australia one of Porsche’s fastest-growing markets worldwide and compares with Porsche growth globally of 17 per cent last year.

“So when we went from 1200 units to 4000 units here we certainly grew at a much faster rate than the rate Porsche globally was growing,” Mr Curtis said.

“We plan for our volume and we are very careful not to tip the scales the wrong way.

“So the growth that we have experienced in the past two years will not continue. There has been a bit of catch-up for us but from now on it will just be organic growth.

“So we played catch-up and going forward we just have to make sure we keep the volumes where they need to be – although at this stage we are supply-constrained because we are pretty much running at capacity,” Mr Curtis said.

He said Porsche was not interested in “pushing more cars into the market for the sake of it. We will assess and we will decide what this market is good for and warned that there was great danger for a prestige brand when it received too much stock and starts pushing cars into the network.

“We have seen that with the other German brands. For us we are very mindful of it and we don’t want to fall into that trap going forward. We (PCA) have some sort of autonomy there with Porsche AG. We make that decision and justify it back to Germany. If it makes sense then they are accepting of it.

A fine balance between volume and excess

“It is the fine balance; at what point do you have too many? We also have to stay true to our roots. So it is a fine balance between volume and excess.

“The key thing for us is not what happens at the time of purchase but what happens when an owner wants to make a new purchase? It is making sure they still have equity in the motor car after three years when the lease period is up because that is when you are going to really annoy customers if there is not enough equity left in the car because you oversupplied the market.

“You have to be very careful with volumes so as not to put your customers in a position in three years time where they get burnt and don’t come back. Alternatively they still have equity in their car and the payout is pretty much commensurate with the value of the motor car so they have had a bit of a win and buy another of the same brand.

You have to be very careful with volumes so as not to put your customers in a position in three years time where they get burnt and don’t come back

“That is critical for us and for Porsche AG. We all have sales targets but I can say on the record that it is not just sales volume that drives our business. There are other objectives that we have and one of them is that we want to be the most profitable car manufacturer in the world.

“But to achieve that you still need other key supportive indicators that help achieve that like raising the bar on customer satisfaction, employee satisfaction and product quality.

“If you get those elements right, the sale volume is a by-product of all that.”

Mr Curtis observed that he thought the German prestige brands were targeting too many cars.

“For them it is about global supremacy. Who will be the leader next year?” he said

“We don’t put the cart before the horse here (at Porsche). Sound business principles dictate our sales volume over time as opposed to saying: Let’s build 10,000 cars and let’s then find homes for them. That’s not the way the Porsche model works.

Asked what brands keep him awake at night Mr Curtis said: “While we have to be mindful of what the other brands are doing, they don’t really influence the decisions that we make here.

“We make decisions on what is best for our customers and the Porsche brand. So we don’t necessarily look at what they are doing and make decisions based on their results or their performance. That’s not our business model.

“We also like to think we lead rather than follow. And maybe others are looking at us and making decisions based on what we are doing. So, first and foremost, our decisions are made on what is right for the Porsche brand and the Porsche customer.

And it works. Porsche’s net profit on sales globally last year was 16 per cent. The company is hoping to preserve that rate this year but there have been significant heavy investments of late which will probably see 15 per cent for this year.

Customer programs meet increased demand

In spite of rapid growth in sales and an influx of people Porsche has never seen in its showrooms before – and new faces behind the wheels of it cars – the company has held its line on delivering its well-proven customer programs which are essential to making its customers feel important and included.

This takes planning because logistically Porsche’s major owner programs involve owners using their cars and its customer support events now have more customers taking part like the Porsche Targa Tour which was run in early April ahead of the Targa Tasmania..

Customers pay a fee and bring their own cars to Tasmania. Porsche organises to put the car in the boat, owners get five-star breakfast accommodation. Porsche closes all the stages of Targa Tasmania route and Porsche owners get to exclusively drive every stage of Targa Tasmania before the competition cars..

There are five packs, each with a Porsche driving instructor; fast for the professional and semi-professional but if you want to drive your Macan in the event with your wife you can go in one of the slower packs where you follow another Porsche driving instructor.

Mr Curtis said: “The whole thing is about living the experience of Porsche and we are now seeing Cayenne drivers so it is appealing to a wider Porsche audience.”

Two years ago there were 30 participants and this year there were 60 participants. When we were at 30 most of them were sportscar enthusiasts but with the 60 there were 16 or so SUVs.

“So clearly we are appealing to a wider Porsche customer appearing at our events. This year’s event was fully subscribed.

Two years ago there were 30 participants and this year there were 60 participants

Porsche now has its own dedicated facility, the Porsche Pavilion, at the Australian Grand Prix and this year many Macan owners enjoyed Porsche hospitality at the Grand Prix.

Mr Curtis said: “The are an increasing number of customers, who are new to the brand, taking part in the Porsche driving school at Mt Cotton in Queensland; wives, husbands, partners, girlfriends are shouting each other driving experience courses with Porsche.

“So every customer activity we have is now widening up to a new group of customers. They are the same events. We are not reinventing the wheel.

“We are very good with our one-on-one marketing to our customers so we create the awareness and alert them to the events we have. Many of them say to us: ‘I did not know you can do that’. And we tell them: ‘Now you can’.

“Most of the customer events are participatory with your Porsche. But two years ago the company introduced the Australian Golf Challenge which feeds into a global golf world cup. About 90 per cent of our customers have golf as a preferred interest so it made sense to introduce it.

The Carrera Cup is designed for both professional drivers at the front of the grid and then the semi-professional driver who plays with Carrera Cup; that’s his eight weekends of golf a year – albeit very expensive. But those guys who own race cars probably own five or six Porsche road cars as well.

Customer recognition at Porsche is vital

Mr Curtis said: “It might sound corny but our customers like to be acknowledged and recognised.

“They can walk into this dealership and the reception will know them and what coffee they have, the service staff will know them, the general manager will know them and the sales staff will know them. The are acknowledged as members of the Porsche family.

“We can do that because, sticking to 10 per cent of the volume the other brands do is about the right size for us. It allows us not to over-grow or dilute the experience of being a Porsche customer and all the tangibles and intangibles that come with it.

By John Mellor

Read More: Related articles

Read More: Related articles