IS THE BILL OF EXCHANGE A HINDRANCE TO THE DIGITALIZATION OF TRADE?

Overview

In terms of the URC522 article 2, Documents may include either financial documents such as Bills of Exchange, Promissory Notes, cheques or other similar financial instruments with commercial documents such as invoices, transport documents or any other document called for in the underlying commercial contract. Banks generally deals with documentary collections. By definition, documentary collection may or may not be accompanied by financial documents. What does this mean? As per URC 522, the Bill of exchange is not a ‘Must’ for a documentary collection, unless 'non-submission of the Bill of Exchange contravenes the provision of a national state or local law and/or regulation. Therefore, as far as the documentary collections are concerned, the presentation of a bill of exchange is not mandatory. On the other hand, when handling a collection what the bank does is; to follow the instructions of the collection letter given by the principal (seller). The same instructions are conveyed by the remitting bank (seller's bank) to the collecting bank (buyer's bank). The remitting bank does is a job of a post office'. In a normal collection, neither the remitting bank nor does the seller receive an undertaking from the buyer’s bank concerning the payment. Hence it is worth looking at ‘why then does anyone consider; Bill of Exchange a stumbling block for the digitalization of trade?’

Need for Less Complex Solution

The remitting banks that discount or forfait collections in paper form to provide post-shipment finance might have a feeling of insecurity without a legally enforceable document like the Bill of Exchange. In the absence of an undertaking from the banks under a collection subject to URC, the remitting bank that discounted or purchased a documentary collection needs to seek redress under the prevailing legal framework. In such a scenario the availability of Bill of Exchange duly presented might help the bank to proceed with recovery action against the presented but unpaid bill as the holder in due course under the Bills of Exchange Act and the seller as the affected party under the sales contract outside URC subject to country law. If an accepted bill is unpaid on maturity, it shall be construed as a default by the buyer since he has accepted his indebtedness by signing over the draft. Hence the seller has recourse to the buyer for recovery against the dishonoured bill and the bank that discounted or forfaited the documentary collection accompanied by a bill of exchange has recourse to the seller (Drawer) as the Bona-fide holder of the bill. In that sense, a correctly worded and duly presented Bill of Exchange under a collection shall yet remain an important financial instrument. No replacement for this valuable payment instrument has been found, although several alternative methods have been suggested to safeguard its security aspect. I believe it is a pressing need to find a reliable and less complex payment instrument. I understand that, towards finding a solution to this need, ITFA is doing a great deal of work - possibly an acceptable solution would be found shortly.

General Perception and the Future of Digitalization

We are now in the Fourth Industrial Revolution brought to the fore by the Digitalization of documents focusing more on quality in all respect. I have always been dreaming of payment instruments invented by new technology but my dream to see the development of trade fueled by digitalized documents has not yet materialized. The experts are of the view that because of legal impediments, the expected development has not yet seen the reality compared to the developments that have taken place in other areas relating to supply chains like manufacturing, shipping and distribution. Financing, which is the cornerstone of international trade, remains yet the missing link of the supply chain. Despite several solutions proposed by various institutions including ICC, hardly any solutions so far have addressed adequately the minds of bankers or financial institutions that provide financing especially to SMEs who are in much need of trade-related funding. According to Asian Development Bank, there exist a funding gap of over USD1.5 trillion. This might be even more now.

It is in a way consoling to note that the Covid19 pandemic however, has served to focus attention on the need to digitize world trade both to save cost and resilience. Looking at the way the technological development is taking place, it is apparent that more focus has been on manufacturing process leveraging new additives processes and internet of things (IoT) but a lesser focus on Financing Supply Chain.

ITFA considers that the major obstacle for paying attention to financing of the supply chain is; the lack of enthusiasm from the financing sector owing to the inadequacy of legal cover concerning digitally or electronically produced documents compared to traditional paper documents that have adequate legal cover. To remedy the situation, ITFA continues its lobbying with UK Government to amend the Bills of exchange Act1882 to provide for ePUs (Electronic Payment Undertakings) which is going to be one day an electronic negotiable instrument. Some believe that the proposed ePU will be the turning point for those who aspire to benefit from digitalized trade with full legal protection.

Way Forward

Should we wait until the legal hurdles are removed to embark on paperless trade? With the existing rules promulgated by ICC, especially UCP and URC that have now been supplemented by eUCP and eURC together with UNCITRAL developed model law on electronic transfer of records (MLETR), we are in a better position to muster paperless trade without much difficulty. Therefore, shouldn't we need to first look into the possibility of achieving a ‘near paperless’ environment within the existing framework, and then focusing to transform the system to a ‘fully paperless’ environment once the expected legal framework is in place.

Going for Interim Solution

My opinion is based on the fact that we already have technology-agnostic rules developed by ICC as supplements to well defined and globally accepted trade rules like UCP and URC. The supplementary rules are, eUCP version 2.0 and eURC version1.0 which support the electronic presentation of documents alone or combined presentation of both electronic and paper documents. ICC has always maintained the independence of its trade-based rules. That is the secret of acceptance of ICC rules worldwide. The neutral position maintained by ICC should not be diluted at any cost by developing rules for digitalized trade in association with vendor institutions looking to gain market acceptance for their products directly or indirectly over those of the competitors.

I wrote an article and posted it on LinkedIn on the importance of finding a substitute for Letters of Credit, taking into consideration the changes in the ecosystem in the supply chain with the developments in technology. In that article, I explained how payments through the LC mechanism were developed to fill the vacuum of a solvent paymaster to guarantee the underlying contract settlements. At that time, when the operation was manual, we saw how the legal concepts were evolving, augmenting the requirements of the manual process. I explained how Letters of Credit played a vital role in ensuring the settlements based on paper documents alone. We are in a scenario where paper documents transforming into data through digitalization. The credibility of data and the ownership of the issuers becoming more accurate than paper documents.

Transforming to Digitalization from Manual Process

The supplementary rules (eUCP and eURC) developed by ICC for paperless trade under UCP and URC provide for the presentation of digitalized/electronic data or paper documents. It also provides for the combined presentation of both digitalized and paper documents. Under the circumstance the sellers (Principals) supplying goods on documents against payment (D/P) or documents against acceptance (D/A) who are also intending to avail post-shipment finance from banking institutions by way of bill discounting or forfaiting face no barriers whatsoever by switching over to either eUCP or eURC. In this paper, I would like to draw attention particularly to collection bills that traditionally accompany Bills of Exchange. The discounting and forfaiting banks consider manually signed Bills of Exchange, their legally valid collaterals for lending. In the absence of legal protection for accepting digital or electronic bills of exchange, financial institutions are reluctant to deal with digitalized/electronic presentation of documents.

Current Provisions supporting Digitalization Effort

Nevertheless, there are provisions within the existing framework and the ICC rules to discount or forfaite Bills of Exchange (BoE) without losing the available legal cover. We know that eURC which is the supplementary rule for Uniform Rules for Collection (URC) allows the combined presentation of both digital and paper documents as pointed out many times in this article. Under the circumstance, the remitting bank (seller's bank) is in a position to first send the BoE by currier to the collecting bank to present it to the drawee for acceptance. The rest of the documents may be transmitted electronically once the acceptance is notified by SWIFT or any expeditious means. It is possible within a matter of minutes. The only precondition is, that remitting bank and the presenting or the collecting bank must have a prior arrangement in place for the presentation of electronic records alone or in combination with paper documents. It is essential that any prior arrangement between the banks describe the required format of each electronic record (article e6 Format) and includes the place for presentation (sub-article e4 (a) (iv) Definitions). This reminds me of the procedure we used to adopt onboarding correspondent banks and entering into agency arrangements.

It is outside the scope of eURC or URC, how the presentation of documents is made to the remitting bank by the principal (seller) or another party on behalf of the principal. This applies to the presentations, whether in the form of an electronic record or a combination of paper documents. What is important to remember is that for any matters not defined or modified in the eURC, definitions given in the URC will continue to apply.

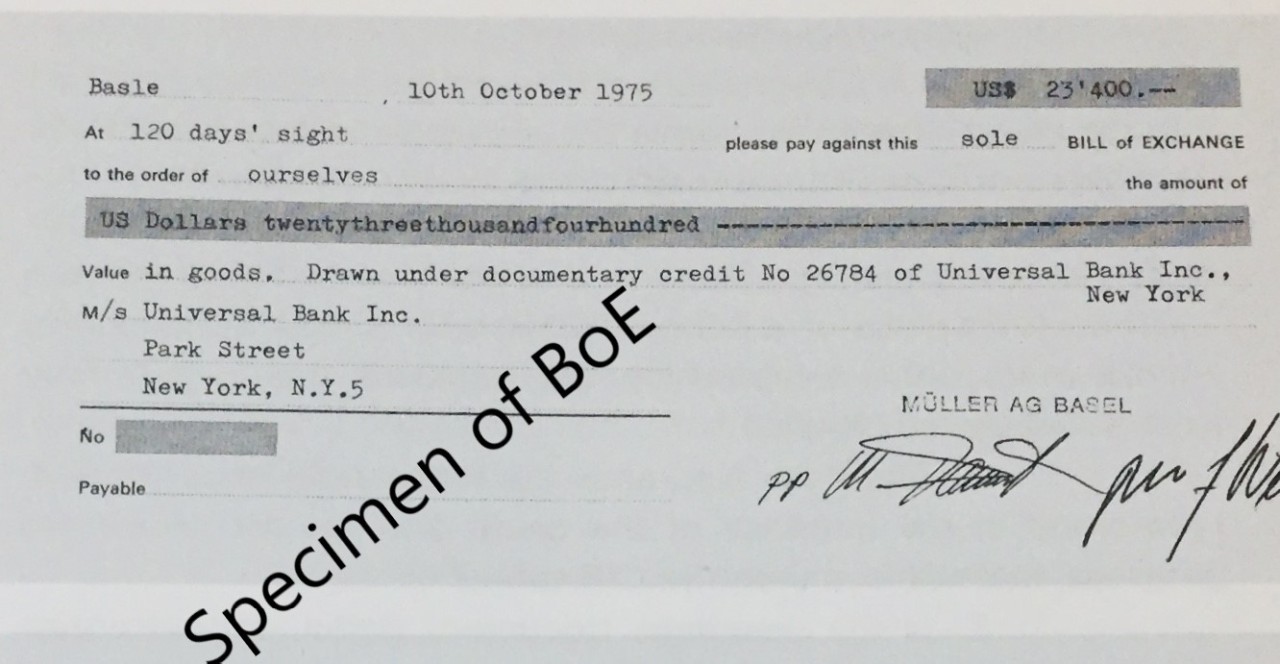

Apart from sending Bill of Exchange through currier for acceptance, the remitting bank on the instructions of the principal is permitted under URC to instruct either the collecting bank or the drawee to create documents like Bills of Exchange, promissory notes, trust receipts, letters of undertaking or other documents that are not included in the collection (URC522 art.8). However, there is a condition that a specimen of the required documents must be provided by the instructing party. In my opinion, the parties involved in the collection operation including the discounting banks and forfaiters should seriously consider utilizing the available options without relying on the impending changes in the legal systems to accommodate electronic or digitalized data in place of documents that are in paper forms.

Digitalization Effort and its drawback

The effort to digitize trade, owing to the above issues considered as serious impediments, has been going on for more than 15 years with near alternate solutions like BPO, and even early platforms such as Bolero that provided access to members only, virtually remain inactive. Boston Consultancy Group (BCG) in their recent survey, have observed that digitalization has gained little traction – maybe because there is a vast number of participants in the trade ecosystem that lack the scale or sophistication to use these platforms, they failed to build the scale required for such network-based products. However, with the ongoing move to open account trade, coupled with an increased appetite for digitization and bank/investor' hype' from technologies such as blockchain, a new generation of innovation, with multiple digital ecosystems, has surfaced over recent years pointed out by BCG. These ecosystems are often the products of consortia of cross-industry partners or sponsors collaborating to establish digital platforms that connect entities within the broader trade finance network and facilitate the flow of data between them.

Although the ongoing digitalization efforts are said to be typically aimed to provide ideal solutions focusing on the following important aspects, it is yet to be seen, how they would help to continue business-as-usual, in a closed operating system where only the ‘members’ who subscribe, could access it. Although the following focal points have received the attention of the promoters of digitalization, I believe their focus needs to be further expanded with a motive of moving away from the relatively unsuccessful ‘Club system’. Hence, What has not received attention is highlighted within brackets for further consideration.

- Harmonisation – the ability for most parties (preferably all parties) involved in a transaction to interact via a single platform

- Efficiency – the automation and simplification of processes, including real-time data exchange, reducing costs for participants (efficacy is also as important as efficiency because the trade finance landscape is fragmented)

- Transparency – the secure sharing of data directly between the fragmented relevant parties who contribute effectively towards the successful operation of trade

- Security – The ability to authenticate parties and record transactions to reduce the chance of fraud, with or without DLT

However, we have seen on and off in the news, some successful transactions completed using digitalization technology. But we don’t see any significant increase in such transactions. The transactions reported are also confined to dominant market players and as such, they do not represent a systemic move to new platforms enabling business-as-usual. Hence, digitalization has to move from the testing environment sooner than later, creating an ideal platform for the players in the trade ecosystem, cognizing that the majority will embrace digitized trade, if the cost is going to be affordable and if they have some guarantee that they will be able to connect freely not only with their counterparties but also with 20 or more fragmented parties who subscribe to seamless trade transactions.

Conclusion

Finally, the responsible parties should focus on the basics. The goal should be to deliver functionality, not technology as correctly observed by Boston Consultancy Group in their survey. The development agenda should focus on removing pain points and listening to customers, not on building hype. If not, it is unlikely we see the transformation through digitalization, despite the contract rules for digitalized transactions are ready for implementation.

Brand ambassador

2yBanks in America don't want us to know about boe. You know where I can get my bills discounted?

Chief Manager - Trade Business Development

2yDigitalization of Trade is the hot topic in current context and your article provides valuable points to discuss further in International Trade. Thank you Mr. Peiris for your effort to start conversation among Tade Practitioners.....