The bill of exchange - today's use cases and tomorrow's opportunities

Views from practitioners on the Bill of Exchange – today’s use cases and tomorrow’s opportunities

5 July 2022

By Sean Bowey, André Casterman, Joysheel Mitter, Robert Parsons and Vishnu Purohit.

As we prepare for global trade to benefit from a major legal upgrade, practitioners in international trade financing shared their views on ways in which the Bill of Exchange is being used today across the world and the opportunities it brings with policy change.

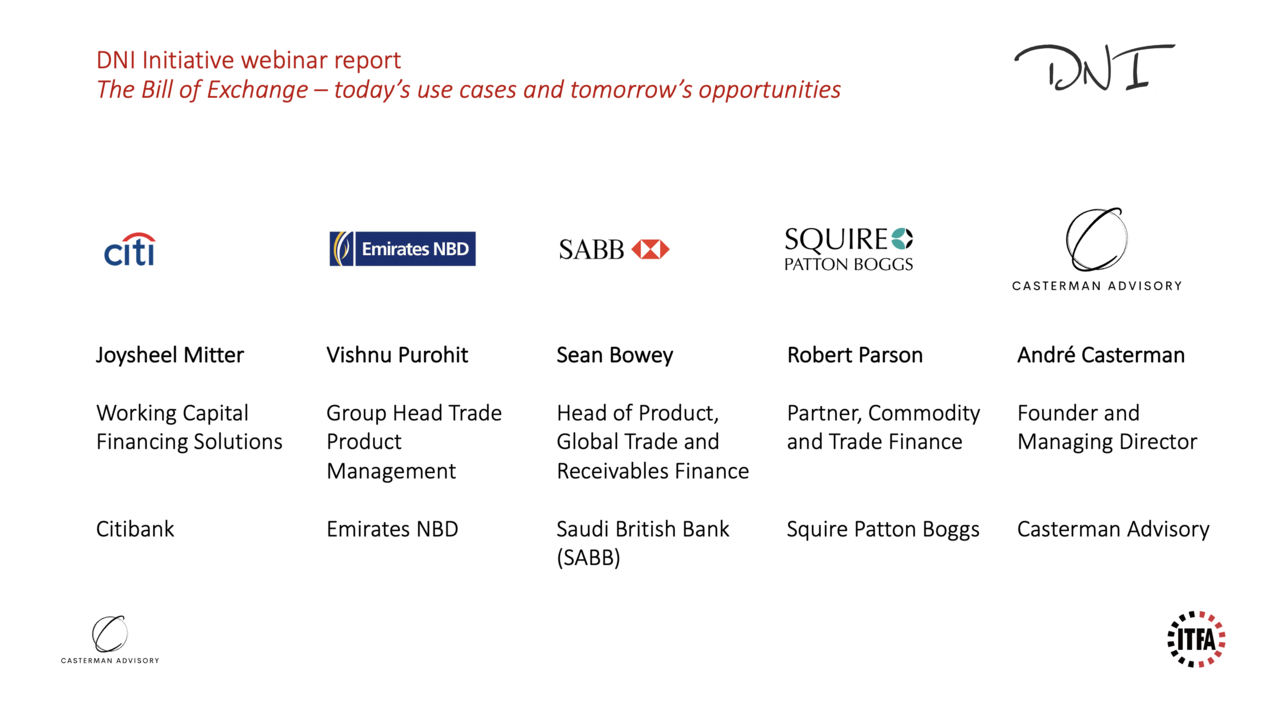

For this session, five members of the DNI Initiative joined the stage:

- Joysheel Mitter, Working Capital Financing Solutions, Citibank

- Vishnu Purohit, Group Head Trade Product Management, Emirates NBD

- Sean Bowey, Head of Product, Global Trade and Receivables Finance, Saudi British Bank (SABB)

- Robert Parson, Partner, Commodity and Trade Finance at Squire Patton Boggs

- André Casterman, Chair Fintech Committee, ITFA and Founder, Casterman Advisory.

We summarise the key messages from the discussion below.

1. The bill of exchange is a debt instrument that has been widely accepted since centuries; it is regulated by the Bill of Exchange Act 1882 and a uniform European law issued from the 1930’s.

2. There are 3 legal characteristics to highlight: (1) it is transferred by delivery only (2) if the transferee is holder in due course, then they take free from most defects in title; (3) the transfer of B/E is legally valid.

3. Corporate clients active at international level love it as the Bill of Exchange (B/E) provides extended credit from a seller to a buyer across multiple jurisdictions. Typical use is when a seller has clients in multiple jurisdictions. Given the long experience of the corporate market with the instrument, it provides a comfortable solution. There is no need for additional documentation for buyers to review as it is often the case with Supply Chain Finance programmes where Irrevocable Payment Undertaking (IPUs) are delivered to banks for extending credit to suppliers. In addition, the Bill of Exchange is not characterised as bank debt whereas in the case of IPUs there is a need for validating the accounting implications. In other words, the IPUs present a risk of re-classification whereas the B/E shields corporates from such risk.

4. The payment obligation arising from a bill of exchange is independent from trade agreements and documents. The commercial risk that can arise from trade disputes are excluded from the bill of exchange (in contrast to letters of credit). It is therefore accounted for as off-balance sheet.

5. Non-bank financial institutions acting as originators are also using the bill of exchange given the historical use by banks and the strong legal standing and experience of the instrument in the market. The bill of exchange is widely used in the UK and in the Middle East whilst, its use is much more limited in Western Europe (e.g., France).

6. The bill of exchange can become a much more powerful instrument once the clunkiness around the use of paper and physical transfer of possession are addressed through digitization. In the UK, policy change is on-going as proposed by the Electronic Documents Bill.

7. With a digitized B/E, one can potentially replace the Supply Chain Finance (SCF) agreements - which have the risk of reclassification, with B/Es. With technology a B/E can be automatically contracted at the stage of payable being accepted or approved and yet be invisible and provide the undisputed way of having off – balance sheet treatment.

8. The Electronic Documents Bill aims to enable two key functions - possession and transfer of possession - to be performed fully digitally. The future electronic option as proposed in the Bill put forward by the Law Commission for England and Wales leaves untouched those centuries of legal decisions which is precisely what makes the B/E a very much tried and tested instrument in international trade. It is crucial to avoid re-inventing the wheel which would upset all the confidence that people have globally in the instrument and in the system and in the way that it works. Once this Bill becomes Law and the electronic Bill of Exchange exists under English law, other countries will perform similar legal changes, and this will ultimately produce a network of countries enabled to transact on digital bills of exchange.

9. We expect several jurisdictions which are based on the English common law to follow the UK example in terms of aligning to MLETR. The Saudi Arabian regulator are very much engaged on the adoption of a framework that would allow for digital documents of title following what happened already in Singapore, Bahrain and Abu Dhabi. There is a strong willingness from Saudi policy makers as part of Vision 2030. The French and German markets have also launched their own MLETR project.

10. We also expect the bill of exchange to benefit faster from digitization than bills of lading. The major opportunity for banks and non-bank originators to identify product innovations and generate new business opportunities using the digital bill of exchange.

11. Institutional investors will be very interested in such instrument by extending liquidity to originators whether acting as banks or non-bank FI’s. Today, institutional investors are keen on IPUs, so we expect capital market firms to be keen on the “bills of exchange” investment class.

12. The ITFA DNI Initiative has developed standardized wording around digital bill of exchange and digital promissory notes which will support harmonization and automation.

13. The Bill of Exchange, Promissory Notes and Bills of Lading are international ‘treasures’ that are worth upgrading to deliver even more value to the market in the future.

We look forward to continue engaging with the trade finance community on further market developments around the DNI Initiative. Reach out to members of the DNI Initiative for further insights.

Replay the webinar by accessing the recording via the ITFA member area tab “Webinars”.

For more insights, read my blogs on the DNI Initiative:

Digital Trade Strategist & Advocate | Trade and Supply Chain Finance

1yThanks André Casterman . Very good report and esp. agree with “We also expect the bill of exchange to benefit faster from digitization than bills of lading.”. While the eBL, if fully interoperable between all participants across platforms without requiring a switch to paper, offers great potential, the hurdles are much lower with a digital B/E and P/N. The ability to digitally formalise a financial commitment (as a digital asset) would provide a powerful combo with e.g #einvoicing which already is at a more advanced stage, thereby creating immediate potential synergies. Ideally, you would ofc combine the power of the digital B/L and B/E, as described in the ICC United Kingdom’s Digital Trade report (case study 4 from China Systems): https://www.chinasystems.com/press/icc-uk-digital-trade-solutions-report-features-china-systems-business-case-on-digital-collection-with-receivables-financing