Meaning and Features of Bills of Exchange

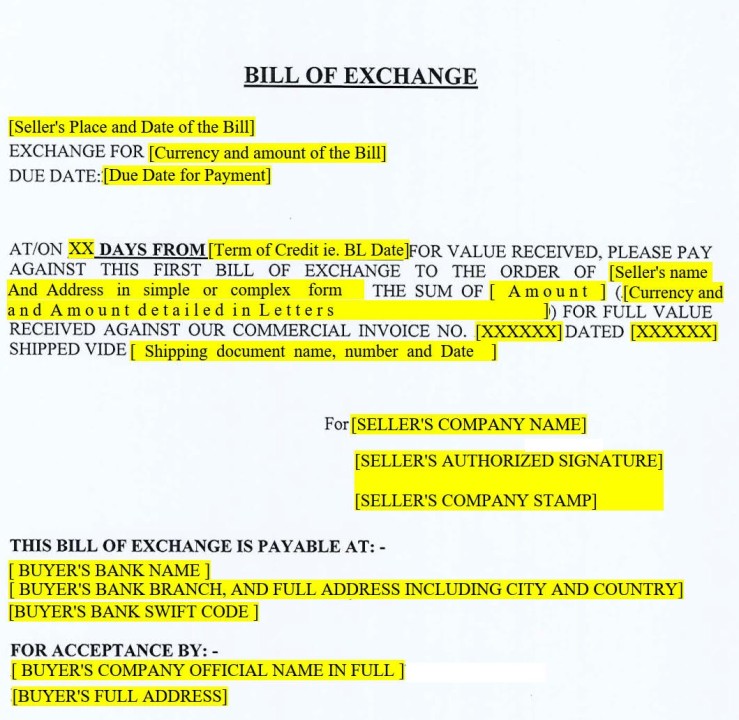

A bill of exchange, a short-term negotiable instrument, is a signed, unconditional, written order binding one party to pay a fixed sum of money to another party on demand or at a predetermined date. A bill of exchange is sometimes called draft or draught, but draft usually applies to domestic transactions only. The term bill of exchange may also be applied broadly to other instruments of foreign exchange.

Bill of exchange means a bill drawn by a person directing another person to pay the specified sum of money to another person. A bill of exchange is of real use if it is accepted by the person directed to pay the amount.

For example, X orders Y to pay ₹ 50,000 for 90 days after date and Y accepts this order by signing his name, then it will be a bill of exchange.

In general practice, the seller gives a credit period to the buyer on selling goods or on providing services.

But sometimes, the seller is not in a position to offer credit period to purchaser and purchaser also will not be in a position to pay immediately.

In such a case, the seller will like that the purchaser shall give a promise in writing to pay the amount on a certain date.

This written promise then turns into valuable instruments of credit when this written promise are made in proper form and is properly stamped.

These written instruments are often accepted by banks and we can advance money against them. Also, we can endorse this instrument i.e. can pass to another person.

Features of Bills of Exchange

The following are the features of bills of exchange:

- A bill of exchange an instrument in writing.

- It is drawn and signed by the maker i.e. drawer of the bill.

- It is drawn on a specific person i.e. drawee, to pay the specified amount.

- Contains an unconditional order to a person i.e. drawee.

- To make an instrument of value the drawee must accept it.

- The specified amount is payable to the person whose name is mentioned in the bill or to his order or to the bearer.

- It specifies the date by which amount should be paid.

- Payment of the bill must be in the legal currency of the country.

- It must be properly stamped.

- It must bear a revenue stamp.

#Billofexchange #Draft #Export #Import #Exportimport #Importexport #Exporter #Importer #DeferredPayment #letterofcredit #DocumentaryCollection #PaymentInstruments