What time do you think it is on the Economic Clock? We would really appreciate your thoughts.

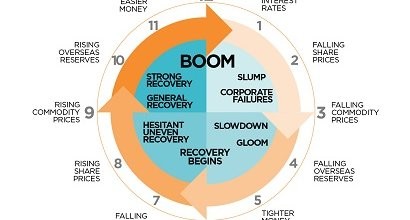

For those who are not familiar with the Economic Clock, it is a mechanism that has been around for decades, used to track or forecast the state of the economy. The economy is said to move in cycles and the clock can indicate when it is appropriate to buy or not to buy certain types of investments. The inner circle addresses the state of the economy and the outer circle the asset classes and they are normally aligned. However, it is only an indicator as we will continue to discuss below. Please note 12 o'clock is rising real estate prices and 6 o'clock is falling real estate prices.

We use the economic clock to have discussions with our clients around their confidence to invest in their businesses. Bear in mind, the indicators can vary by industry or geography, and though the last 6 months have been tumultuous the economy overall is improving. Today, we thought we would ask you where do you feel we are on the cycle and how confident are you about 2018 and beyond?

Stock price fluctuations get a lot of the press and usually the economy follows stock market trends some time later. However, we don’t get involved in stock market predictions, we use this tool to guide our conversations around the overall economy is going in terms of job creation, consumer confidence and industry trends etc. This is what really influences our client’s growth plans. Think back to March of 2009 when stock prices sharply rebounded. At that time, many business owners were still feeling the effects of the recession and laying off staff and consolidating overhead. It was not until 2012/13 that the local economy in general took off. So what time was it then locally? Probably 8 o’clock but in 2012, I remember presenting a workshop for the construction industry and they were not sure they had even reached 6 o’clock by then.

By now you get the picture; though the economy is improving, business responses are varied. So why are we asking for your input? The truth is that input from the front lines of business can prepare us for what is around the corner even when globally the clock gets out of cycle which is what happened in the last great recession. A couple of examples: Firstly, China was still expanding when much of the world was already in recession so commodity prices remained high and as a result Australia did not go into recession until the rest of the world was pulling out of it. Rising commodity process are normally associated with 9pm but the rest of the world was probably around 2am so complete dislocation. Secondly because the central banks were initially pumping money into the system we had low interest rates and easy access to money (although if you ask the average small business owner they may have a different opinion). Again, low interests are not normally seen till 7pm, normally it is high interest rates as witnessed in the early 80’s under Regan.

The world has only seen two such dramatic dislocations of the economic clock this last recession and the 20’s crash, so there is a lot of good reason why people have been slow to believe in the upturn, especially if you are a millennial and never experienced a bull economy. Again, we are looking for your thoughts however contrarian they may be.

Historically the economy trails the stock markets, so the economy could be in for a good run up as well. Our research shows that the market also goes in cycles of 18 years up and 14 years flat, with major fluctuations along the way. Follow the link to see why we could in the throes of 18 years of growth which also could affect your vision of the state of the economy and why this may also be the time to Jump your business to the next level.

What time is it from your perspective? What challenges or benefits do you see? We would love to receive a brief note or if you prefer let’s have a call or coffee. You never know, but there might be a follow up article talking about some of the trends you all see.

Nigel Hartley is a Business Advisor with Shirlaws and Director of Shirlaws USA part of the Shirlaws Group where we help businesses “Grow, Fund, Exit. www.shirlawsgroup.com. You can contact Nigel on 707 573 7154 or by email at nigel.hartley@shirlawsgroup.com